Published

7 years agoon

By

CalMatters

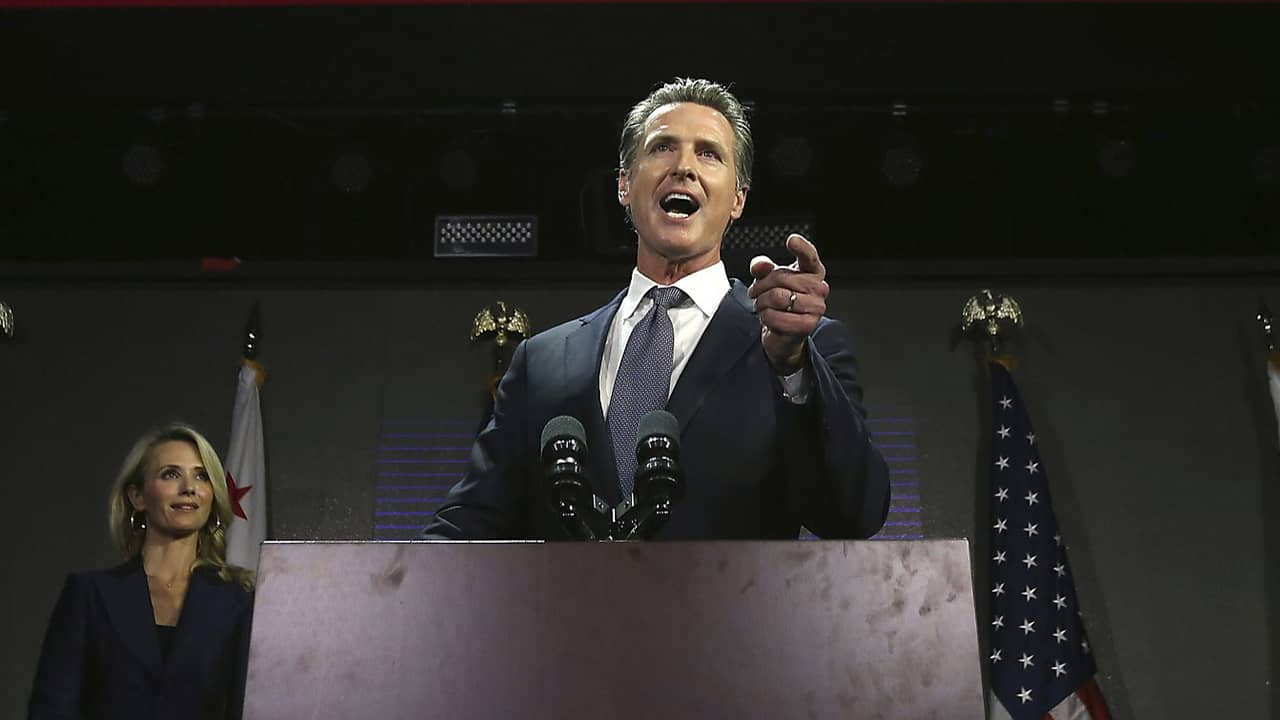

The good news just keeps coming for California Gov.-elect Gavin Newsom.

By Dan Morain

CALmatters

Not only did he win a resounding 60 percent-plus landslide, but he will be greeted by a two-thirds supermajority of fellow Democrats in both houses — more than sufficient to approve a tax increase. Not that he’ll need it any time soon.

That’s because he’ll also inherit a $200-billion plus budget that, as it turns out, is in “remarkably good shape” heading into the coming year, with nearly $30 billion in combined reserves and unexpected tax revenue, the Legislative Analyst’s Office reported last week.

“By historical standards, this surplus is extraordinary,” the analyst wrote in its annual fiscal outlook for the 2019-20 budget year.

So is Newsom’s luck, says Hoover Institution research fellow Bill Whalen, who worked in Gov. Pete Wilson’s administration. “This,” Whalen said Wednesday, “is living under a fortunate star.”

One reason for the analyst’s projected surplus is that spending increases will be “very low” for a variety of reasons, not the least of which is that under Gov. Jerry Brown, lawmakers have sought to limit increases in ongoing spending.

Eight years ago, when Brown was governor-elect, California was mired in a recession. The state faced a $27 billion budget deficit. Some experts doubted that California could remain solvent.

In its fiscal outlook in November 2010, the LAO issued offered the stark choice: “Address today’s huge, frustrating budget problems now or defer the state’s budgetary and policy problems to future Californians.”

Brown responded in 2011 by asking the Legislature to approve a sales and income tax increases. Republicans, who still had clout then, blocked his appeal.

Brown then turned to voters who answered by approving a ballot measure raising taxes in 2012. Voters extended that higher income tax rate by initiative again in 2016. By the time Newsom completes his first year in office, revenue from personal income taxes in California will have increased by 46 percent since 2012-13.

Income tax revenue, much of it paid by people earning $1 million or more, will account for $101 billion in the coming year, or 71 percent of the revenue that flows into the general fund. The general fund pays for the state’s share of most programs, including schools, universities, health care, and prisons.

While revenue rises, California’s spending is leveling off for a variety of reasons:

The analyst notes that spending on Medi-Cal, the main health care program for poor people, is increasing less rapidly in part because California under Brown has succeeded in enrolling about as many people as are eligible.

“I’ll give you the asterisk now,” said Ann Hollingshead, senior fiscal and policy analyst for the LAO who along with Deputy Legislative Analyst Carolyn Chu provided CALmatters with the budget briefing. The surplus includes $14.5 billion that by law must stay in the reserve, plus $14.8 billion in a one-time revenue surge.

That’s the largest projected surplus ever in California. But as a percentage of the budget, it’s second to the projected surplus in 2000. That year, the Legislative Analyst anticipated $10 billion in extra state money. Then the dot-com bust hit. The supposed surplus transformed into a $12 billion deficit.

“We tell that story as a cautionary tale,” Hollingshead said.

In other words, the LAO suggests, Newsom and his supermajority would be wise to sock away the vast majority of the $30 billion windfall for the recession that at some point surely will hit.

Whalen echoes that caution, noting that the Legislature will likely besiege Newsom with spending requests, which he should resist, if only to manage expectations — which will be formidable, given the hand that Newsom wields now. His advice? A fiscal showdown.

“When Jerry Brown came in in 2011 he did a very good job of setting the tone and tenor for the Legislature (by) vetoing the budget,” Whalen said.

“That was a very effective way of saying: You will not push me around.”

Laurel Rosenhall contributed to this report.

CALmatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.

California Pins Vaccine Hopes on Biden Administration

Walters: After COVID-19, Drought Threat Still Looms

Fierce California Winds Fan Fires, Topple Trees and Trucks

Monarch Butterfly Population Moves Closer to Extinction

Newsom Sets New Tone for California, White House Partnership

California Guard Pleads Guilty to Lies in Inmate’s Death

Michael Pistoresi

November 20, 2018 at 10:52 am

The good news for Newsom is not such good news for the taxpayers of California who continue to be bombarded with ever higher fees, taxes and burdensome regulations heaped on them by unelected bureaucrats.