Published

5 years agoon

Internal Revenue Service employees at the Fresno campus will return to work on Monday, according to an internal email to workers from IRS Commissioner Chuck Rettig.

The start date was confirmed by the National Treasury Employees Union, which represents IRS employees.

“Employees in California, Indiana, Ohio, Puerto Rico, and Oregon, including the large campus in Fresno, are due to report on June 29,” the union said in a news release.

Those employees considered to be “high risk” for COVID-19 will continue to work from home or remain on administrative leave, the union said.

A Fresno IRS employee told GV Wire℠ via email Monday night that a supervisor said the campus wouldn’t be fully staffed. In addition, supervisors are asking veteran employees to “volunteer” to work onsite. The expectation is, the employee said, that seasonal temporary workers will be required to report to work.

Face masks and sanitizer will be provided to employees and workstations will be spaced for social distancing, the employee said.

The Fresno campus has been closed since noon on March 20 because of the coronavirus pandemic. In an email to IRS employees at that time, Craig Stevens, the senior commissioner’s representative for Fresno, said that employees would be expected to work from home or another location if they had the proper technology or when the technology was put into place.

In April, the IRS closed all of its service centers, citing shelter-in-place orders.

The reopenings began at centers in Utah, Texas, and Kentucky in early June, followed by mid-June reopenings in Michigan, Georgia, Missouri, and Tennessee.

The Fresno regional center, which processes tax returns, employs about 5,000 people.

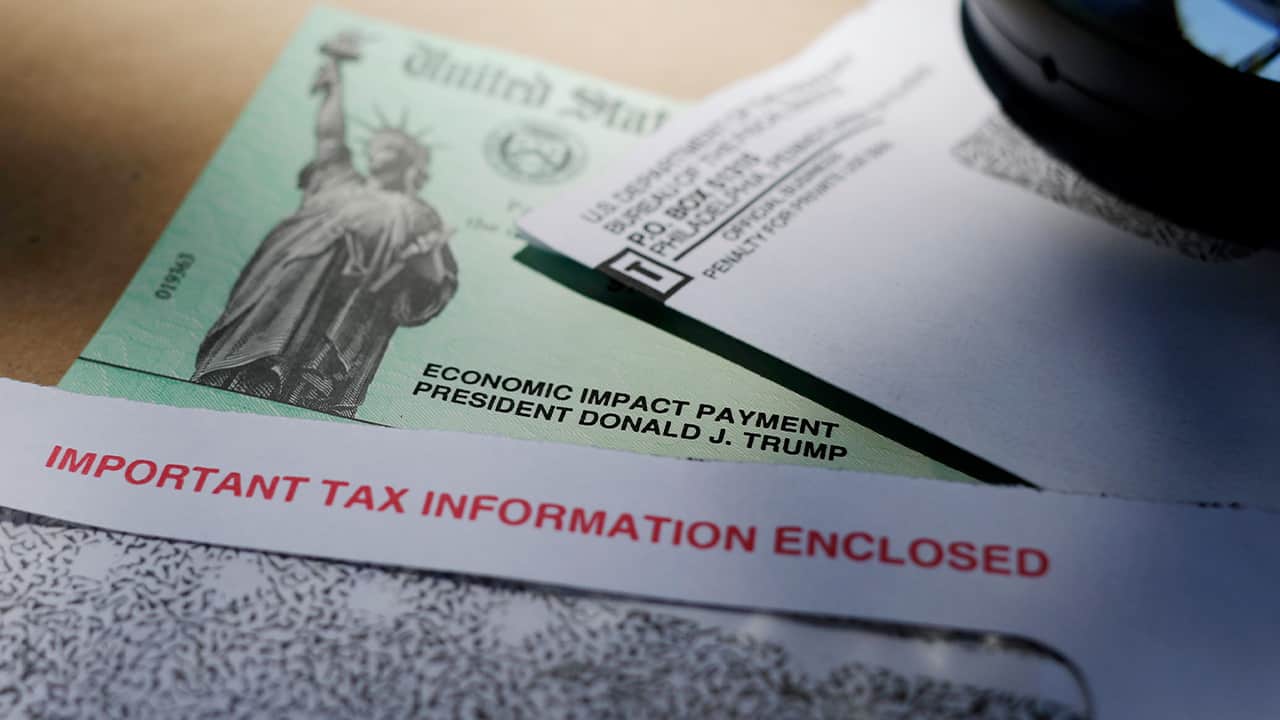

As businesses started to close in March because of the pandemic Treasury Secretary Steven Mnuchin pushed the federal income tax filing deadline from April 15 to July 15.

According to IRS data, the number of tax returns processed through June 12 was 124,631,000. That’s down 12.2% from the same period in 2019. And the number of tax returns received was 136,509,00 — a 5.3% drop from the corresponding 2019 period.

Treasury Secretary Steven Mnuchin said Tuesday he would consider another delay of the federal income tax filing deadline. He previously pushed it back from April 15 to July 15. (AP File)

During a virtual event hosted by Bloomberg on Tuesday, Mnuchin said that he might further delay the tax deadline.

“As of now, we’re not intending on doing that, but it is something we may consider,” Mnuchin said.

The Hill reported that Mnuchin’s comments come after a group of conservative organizations urged him to further extend tax-payment deadlines into next year, arguing that doing so would “give the economy some much-needed breathing room.”

Bill McEwen is news director and columnist for GV Wire. He joined GV Wire in August 2017 after 37 years at The Fresno Bee. With The Bee, he served as Opinion Editor, City Hall reporter, Metro columnist, sports columnist and sports editor through the years. His work has been frequently honored by the California Newspapers Publishers Association, including authoring first-place editorials in 2015 and 2016. Bill and his wife, Karen, are proud parents of two adult sons, and they have two grandsons. You can contact Bill at 559-492-4031 or at Send an Email

Study: First 10 Days After Leaving Hospital Pose Deadly Risks for COVID Patients

Bay Area Restaurants, Wineries File Lawsuit Over Outdoor Dining Ban

Madera Hospital, With ICU Inundated, Transfers Patients to Other Facilities

‘Shameful’: US Virus Deaths Top 400k as Trump Leaves Office

Bill McEwen: Five Steps to Heal America Under Biden

Trustee Slatic Calls for ‘Redshirt’ Year for High Schoolers When In-Person Classes Resume

Jerald Helland

July 3, 2020 at 9:16 am

I submitted my paper 2019 income tax return on March 5, 2020 to California. Thus far I have not been able to get any information regarding a refund status. I have submitted several requests for assistance from Senator Durbin’s office, with no response. Help.

Tari ONeill

July 3, 2020 at 12:41 pm

I submitted my paper tax return on March 30, 2020 but have heard nothing. Have you called the Fresno office since they opened?

Dar Shinskie

July 4, 2020 at 12:33 pm

Checked online to IRS all processing centers were closed due to Covid 19. IRS processing center in Fresno suppose to reopen end of June. We are waiting for our tax info too. Think it will be awhile .

J Younes

July 4, 2020 at 4:56 pm

I sent my paper return from Michigan on April 7 and it took the USPS 10 days to deliver it to the Fresno PO Box on April 17. Still, we keep checking online and no information. It is a problem when you are using the refund to pay estimated taxes. I am thinking now of attempting to file electronically and send the couple of attachments we need to add by mail to a different address.

L Ordway

August 11, 2020 at 4:12 am

Have you gotten your refund? I am in the very same situation!

Jessica

July 8, 2020 at 8:30 am

I’m in the same boat. What happens if our tax returns are not reflected/processed by July 15th. Should I file for an extension?

Eddie Arcadia

July 13, 2020 at 10:50 am

I’m in the same boat. I mailed my return April 7th but no refund and no stimulus payment. I checked the ‘Wheres my refund’ tool and it says no info. I dont know what to do.

Yoshira Alba

July 13, 2020 at 8:27 pm

I filed electronically February 18th and still nothing. Where’s my refund!?

Patrick Fox

July 14, 2020 at 5:52 pm

I filed my 2019taxes in california on march 23rd 2020 and i havent heard nothing from my taxes and never got my stimulus check

Maceo McCrory

July 26, 2020 at 6:25 am

I filed and 3/28 and same here nothing. But on another note… what positive financial gains are people planning to make when our money do hit our mailboxes?

Nettie Weaver

July 29, 2020 at 5:15 am

I’m in Michigan mailed my taxes in March 9 no info or stimulus check

Lois

July 31, 2020 at 12:49 pm

I mailed IRS payment June 23. Check has not yet cleared. I do not want to cancel then have them process. The IRS rep said I should wait another month for them to process payment. It does not make sense that they cannot process payments.

Jennifer

August 13, 2020 at 12:16 pm

I submitted my paper 2019 amended income tax return in March, 2020 to Fresno, California. I was told the office had closed but has now reopened. How long is it going to take to finally see something about the status? Getting a little annoyed that I am not receiving needed money.

Donna King

August 17, 2020 at 11:50 am

I filed back in February and still no refund asked for help with the taxpayer advocate still nothing.

Jennifer

August 13, 2020 at 12:18 pm

I sent mine in March to California. Also no status or stimulus check! Boo!

Jaslin

August 15, 2020 at 5:19 am

Paper filed at the end of Feburary. My return is still processing. Its been processing since July 14th. Sent to California. There is a pandemic going on and I really need my refund for BILLS. This is unacceptable. I believe this is the Fresno campus that is behind. I just dont understand how the IRS in 2020 is so behind and there is no transparency. You cant reach anyone and say just wait. Unbelievable and unacceptable.

L. Whitten

August 15, 2020 at 8:44 am

I called the IRS, the Fresno California employees are not working hard or even working at all. They are in no hurry whatsoever to open any mail. From what they told me on the phone, you can forget seeing that refund for a year or more. He noted that you can request an economic stimulus rebate on your 2020 taxes. However, since they don’t plan on working on paper returns in the near future or ever, you won’t be able to e-file your 2020 return in order to get your tax refund or an economic stimulus rebate since you need your AGI from 2019 in order to do so. If they haven’t processed your 2019 return, the IRS wouldn’t have any record or your 2019 AGI. So, you’re pretty much stuck and there is absolutely no recourse. From what he told me, you just have to accept that you lost your 2019 tax refund and economic stimulus payments. If you are lucky to get it, it will be years before it happens. The conversation was very deflating. The Fresno CA IRS processing center has absolutely no accountability like the rest of US workers. They should have loaded up all those returns and shipped them to a center who could process them.

Sandy

August 27, 2020 at 12:49 pm

Can we file it again for 2019 electronically ? I understand it is not correct to file it again but doesn’t make sense if it will take that long for them to process it.

Paula A Cather

September 2, 2020 at 9:54 pm

I paper filed to Fresno on March 18 from Washington state. The IRS refund app told me they had received it around the third week of July and I should be getting a refund in three weeks. Here I am six weeks later and still no refund. When will I receive it, if ever?

Paula Boynton

September 13, 2020 at 3:06 pm

I have summited amendment return they received August 6 2020 and I have no update what is going on people need for immigration status and I called my state and they tell me they don’t even see a Tex return so I can’t do amendment return threw them I could have filed threw state but I’m exhausted in California Fresno IRS department needs help update help